Asaan Karobar Card Loan Scheme

Punjab Chief Minister Maryam Nawaz Sharif has launched an “akc punjab gov pk” portal to promote business activity in the province of Punjab, whereby registering, businessmen of Punjab province will be able to get a loan of up to Rs 1 million from the Punjab government.

This loan will be provided to medium-sized businessmen in the Punjab province through the Asaan Karobar Card Scheme provided by the Punjab government. The specialty of this loan is that these people can now repay the Punjab government within three years. If you also want to get a loan of Rs 1 million provided by the Punjab government, then you will be told how you can register yourself for this loan provided by the Punjab government.

What are the eligibility criteria set by the Punjab government for registration? What is the repayment schedule of this loan? And what needs can you use this loan to fulfill? You will be informed with complete details on how you can easily get yourself registered for this loan. So, if you also want to get a loan of Rs 1 million provided by the Punjab Government, then read the article completely.

Features of the akc punjab gov pk loan:

The Asaan Karobar Card (akc punjab gov pk) Scheme offers various benefits to business people in Punjab. Here are its key features:

- You are being told that the maximum loan limit is Rs 1 million, that is, you can get a loan of up to Rs 1 million from the Punjab Government through this scheme.

- You can repay the loan obtained from the Punjab Government within three years.

- You have been provided with the facility that you can use this loan repeatedly for 12 months.

- When you are provided a loan through the Asaan Karobar Card Scheme (akc punjab gov pk), the grace period of the loan will be 3 months.

- You can repay this loan to the Punjab Government in equal installments for the next two years after the first year.

- The biggest advantage of the loan is that it is interest-free for the loan end-user, that is, you will not be charged any additional interest.

Negahban Program Registration Online and Requirements For Free Rashan in 2025

Eligibility Criteria for akc punjab gov pk Loan

The Punjab Government has set specific eligibility criteria so that only needy entrepreneurs from Punjab province can benefit from it. The eligibility criteria set by the Punjab Government are as follows:

- This loan is for entrepreneurs from Punjab province.

- To get a loan, your age should be between 21 and 57 years.

- You are a permanent resident of Punjab province.

- You have a National Identity Card from the Government of Pakistan.

- You are continuing your business activities in Punjab province.

- It should be remembered that only one person can apply for a business.

- To get a loan, your previous credit history must be clean.

- One of the conditions of the Punjab Government is that you have not previously obtained a loan from the Punjab Government or any other government or private institution.

Check If You Qualify! CM Punjab Laptop Scheme 2025 Eligibility Criteria and New Registration Updates

Loan Utilization and Repayment Schedule:

To ensure proper utilization of the loan amount, the Punjab government has formulated specific rules for utilization and repayment:

- You have to utilize 50% of the loan provided by the Punjab Government within the first six months.

- The grace period for using the loan is three months from the date of issuance of the card.

- After three months, you will have to pay monthly installments to the Government of Punjab, which will include 5% of the outstanding loan balance (principal portion only) along with your original installment.

- You will be able to use the remaining 50% of the amount after registering your business with MBR or PRA.

- You can use this loan only for the promotion of your business, while you cannot use this loan for non-essential transactions such as personal expenses entertainment, etc.

- You will pay the remaining amount to the Government of Punjab in equal monthly installments (EMIs) for two years.

8070 Rashan Program Check Online and Register in PSER Before 15 Feb Deadline

Charges & Fees:

The annual fee of the card will be Rs 25,000 + FED, while life insurance, card insurance, delivery charges, etc. will also be included in the card. If you deposit any of your installments late, you will also have to pay late payment charges as per the penalty policy or schedule of charges.

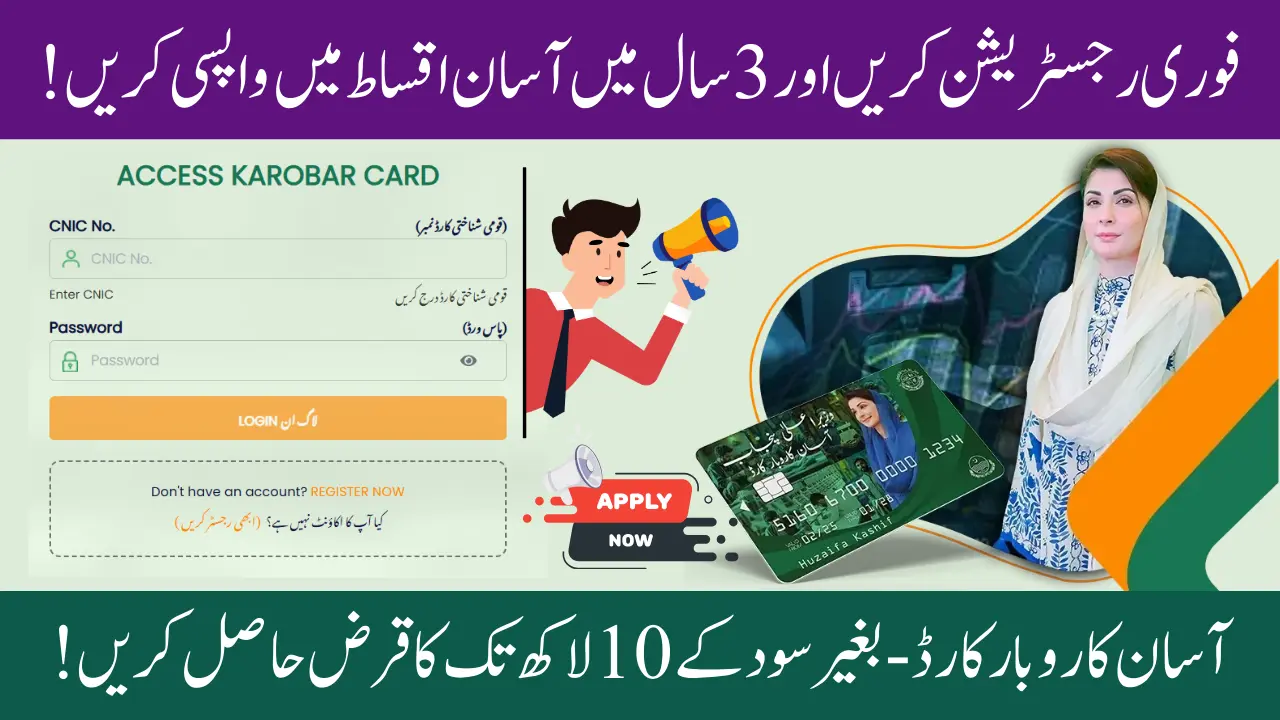

Step-by-Step Registration Process at akc punjab gov pk

You can register yourself by visiting the website of “akc punjab gov pk” provided by the Government of Punjab. Follow the following procedure to ensure registration:

- Visit the website of “akc punjab gov pk”.

- Create your account there with your CNIC, phone number, email address, and password.

- After creating the account, log in with your CNIC number and password.

- Upon logging in, a form will appear in front of you, in which you have to enter your personal information.

- In the next step, you have to enter your business details, such as:

- Nature of business, date of establishment, contact person, business name, email, phone number, address, business registration number, number of employees, rent, monthly expenses, and profit.

- After this, you have to enter the details of the loan application, such as the required loan amount, purpose of use, type of collateral, and nature of the facility.

- Finally, you will be asked to upload the necessary documents, including:

- Photos of the front and back sides of CNIC

- Account statement (if available)

- After providing all the information and documents, apply by clicking on the “Submit” button. After submitting the form, you will be registered with “akc punjab gov pk”.

After the registration process is complete, if the Punjab Government approves your application, you will be able to get a loan of up to Rs. 1 million from the Punjab Government.

Frequently Ask Questions (FAQs)

What is the akc punjab gov pk Loan Scheme?

It is an interest-free loan scheme by the Punjab government, providing up to Rs 1 million for business purposes.

Who can apply for this loan?

Punjab residents aged 21-57 with a clean credit history and a registered business can apply.

How can I apply for the loan?

Visit akc punjab gov pk, create an account, fill out the application form, and upload the required documents.

What is the repayment period?

The loan must be repaid within three years in easy monthly installments.

Is there any interest on the loan?

No, the loan is completely interest-free.

Can I use this loan for personal expenses?

No, the loan can only be used for business purposes.

What is the grace period for repayment?

The first three months are a grace period; repayments start afterward.

Are there any charges for the loan?

Yes, the annual card fee is Rs 25,000 + FED, along with other applicable charges.

How much of the loan must be used initially?

At least 50% of the loan must be used within the first six months.

What happens if I miss an installment of akc punjab gov pk?

Late payments will result in additional charges as per the loan policy.

PSER Rashan Program New Registration Process and Eligibility Criteria Allocated By Punjab Government

Conclusion

Punjab Chief Minister Maryam Nawaz Sharif has launched a portal “akc punjab gov pk” for traders, from where interest-free loans of up to Rs 1 million can be obtained. This loan will be given under the AAsaan Karobar Card Scheme (akc punjab gov pk) and will have to be repaid in easy installments over three years. The age of the applicant should be 21 to 57 years, permanent resident of Punjab, and have a clean credit history. The loan will be used for business purposes only.